The U.S. solar industry has enjoyed impressive growth of late, with strong forecasts for 2016, but it’s been an at-times bumpy ride as the industry has faced unfavorable rulings and stock-market troubles.

Over the past few months, the U.S. solar industry has soared to thrilling wins (Paris agreement, ITC extension, record installations) and stomached sinking setbacks (Nevada net metering, Supreme Court stay of the Clean Power Plan). The industry cheered last week when SEIA and GTM predicted 16 GWdc PV installations in 2016, yet the stock prices of solar giants like SunEdison and SolarCity are stuck near 12-month lows.

Besides buckling their seatbelts, what can industry stakeholders do in this still-volatile market?

One option is to cut costs and gain market share in solar’s main segments: behind-the-meter (including rooftop residential as well as commercial and industrial (C&I)) and utility-scale. But the smartest developers are cutting costs and looking for an early-mover advantage on the next gigawatt-scale solar segment opportunity.

Community-scale solar is that opportunity, and RMI shows how and why community-scale is a large and emerging opportunity in its insight brief Community-Scale Solar: Why Developers and Buyers Should Focus on This High-Potential Market Segment.

Defining Community-Scale Solar

Community-scale solar refers to mid-size (i.e., 0.5–5 MW), distribution-grid-connected solar PV. Community-scale solar includes both shared solar (i.e., subscribers to solar gardens) as well as small utility-scale systems with utility off-takers.

Shared solar comes in two flavors: 1) programs that are driven by state-mandated policies such as virtual net metering, and 2) voluntary utility-initiated programs. To date, 14 states and Washington, D.C., have enacted community solar legislation. Utilities in at least 24 additional states have voluntarily created shared solar programs.

Though shared solar systems vary in size, the vast majority of shared solar capacity is community-scale. In Colorado and New York, for example, shared solar installations are capped at 2 MW. In Minnesota, systems are now capped at 1 MW. In most instances, shared solar developers seek economies of scale by developing projects at or near these capacity limits.

Community-scale is also inclusive to small utility-scale systems with utility off-takers. Rural electric cooperatives (co-ops), municipal utilities (munis), and investor-owned-utilities (IOUs) have all invested in community-scale solar. For example, coops and munis such as Dairyland Power, a generation and transmission provider (G&T), recently announced plans to purchase 15 MW from 12 community-scale projects. In New Mexico, Kit Carson Electric Cooperative (KCEC) and Springer Electric Cooperative have both developed community-scale systems. And investor-owned utilities (IOUs) have similarly launched community-scale solar projects, such as Georgia Power, which has requested more than 50 MW of community-scale power through its Advanced Solar Initiative.

5 Reasons Community-Scale Solar is a Multi-GW Market

Community-scale solar has unique attributes that both leverage the best attributes of behind-the-meter-distributed solar and utility-scale solar, respectively, and which set community-scale solar apart from those market segments, including:

- Access: Community-scale solar is inclusive to all, including low- and moderate-income households and others who can’t go solar via rooftop for a variety of reasons.

- Affordability: Community-scale solar can approach utility-scale prices and compete with wholesale electricity prices.

- Appeal: Community-scale solar leverages many of the distributed benefits of behind-the-meter solar.

- Availability: Community-scale solar makes use of under-utilized land closer to loads, such as brownfields, carports, and large rooftops.

- Affinity: Demand for community-scale solar is building, with interest growing across utilities, community-based organizations, and other stakeholders, and bullish forecasts for installed capacity growth.

1. ACCESS: COMMUNITY SOLAR IS INCLUSIVE TO ALL

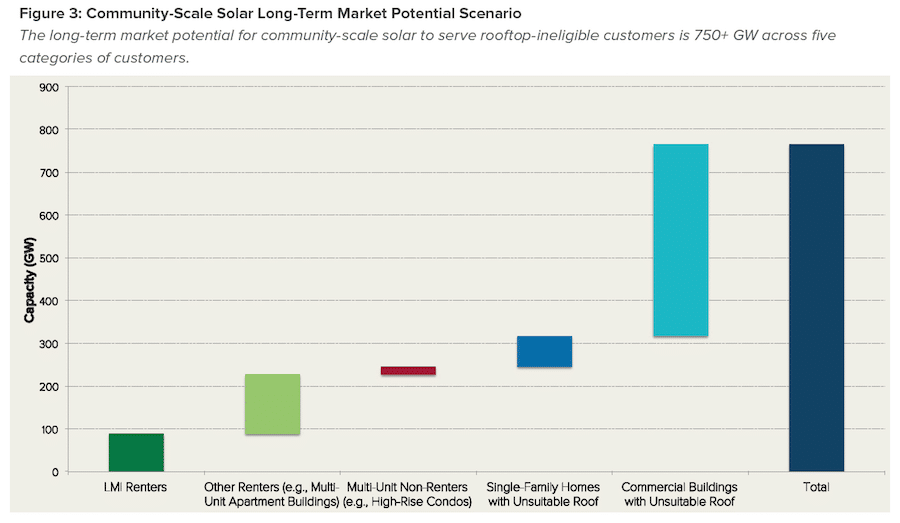

Nearly half of U.S. households and businesses cannot access rooftop solar. According to the National Renewable Energy Laboratory (NREL), 49% of U.S. households are unable to host rooftop solar, either because they rent their home, live in dwellings such as a multi-unit apartment buildings or high-rise condos, or have a roof unsuitable for solar. NREL also reports that 48% of commercial buildings have roofs too small to host on-site solar PV of any meaningful size (i.e., covering at least 20% of demand). Community-scale solar provides access for these customers currently unserved by rooftop solar.

Community-scale solar is also inclusive to low- and moderate-income (LMI) households. In states such as Colorado and New York, community solar laws include a carve-out or preference for LMI subscribers. Rural electric cooperatives are using community solar to serve LMI members. In Rochester, NY, the city is willing to provide sites and other support for community solar, because LMI households have access to the power produced. Even the White House and the Department of Energy are betting that community solar will address the environmental justice barrier of rooftop solar.

Altogether, the community-scale solar market potential for U.S. households and businesses that cannot access rooftop solar is more than 750 GW (see figure). Capturing just one percent per year of this market translates into a 7.5 GW market worth over $10 billion annually.

2. AFFORDABILITY: LIKE UTILITY-SCALE, COMMUNITY-SCALE SOLAR CAN COMPETE WITH WHOLESALE RATES

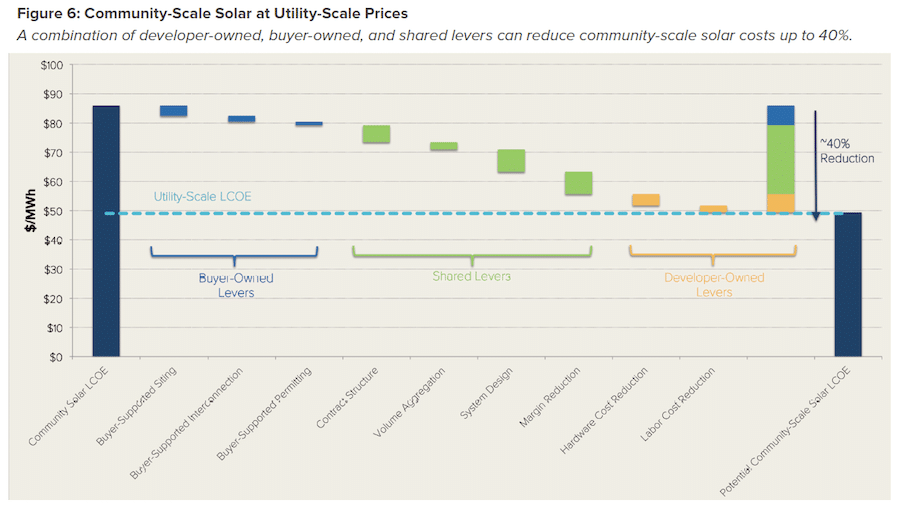

Though community-scale solar prices are currently higher than utility-scale prices (and well below behind-the-meter prices), community-scale solar can become cost-competitive with utility-scale solar and, more importantly, also compete with wholesale electricity rates.

Already, utility-scale solar is competing with wholesale rates in some parts of the country and community-scale will close the gap in the future. To close the gap, community-scale solar prices must come down 40 percent. RMI believes such cost reductions are possible through buyer-owned, shared, and seller-owned levers (see figure).

Buyers can reduce costs by supporting or leading aspects of the development process. Community-scale buyers are often co-ops, munis, or community-based organizations. These community-based buyers are in a unique position to reduce total cost by supporting siting, interconnection, and permitting and zoning. Sophisticated (or well-supported) buyers can effectively act like pre-notice-to-proceed (pre-NTP) developers.

The greatest cost-reduction opportunities are associated with levers shared by buyers and sellers. These levers include efficient contract structures, volume aggregation, solution adaption, and margin cost reduction.

Contract structure: Buyers and sellers can connect around contract structures that capture tax credits and capture low-cost capital available to co-ops and municipalities.

Volume aggregation: Costs will decline when volume is aggregated across portfolios of projects. Volume aggregation increases equipment and personnel utilization and decreases development overhead costs.

System design: Costs will decline as solar solutions are adapted to the community-scale segment. Those solutions will be designed to meet customer needs, remove unnecessary features, and add features that reduce LCOE.

Margin reduction: Buyers and sellers both play a role in reducing cost by decreasing margins to levels appropriate for a competitive and mature market, and to levels more consistent with utility-scale margins. Buyers can manage competitive and efficient procurement processes that help manage risk to the seller and result in the selection of reliably low-cost and high-quality vendors.

Developers and EPCs (sellers) can further drive down costs for community-scale solar by reducing community-scale solar’s non-module hardware and labor costs.

Community-scale solar lends itself to standardization through power blocks. In a not-too-distant future, developers will use standard-design, low-cost, community-scale power blocks for frequently-encountered siting situations, including parking lot canopies, landfills, and ground-mount greenfield sites.

Sellers are already findings ways to decrease costs through standardized power blocks, and they are exploring further cost-reduction opportunities through integrative whole-systems design. Power blocks along with business-as-usual cost reductions will allow unsubsidized community-scale solar to compete with wholesale rates.

3. APPEAL: COMMUNITY-SCALE SOLAR PROVIDES DISTRIBUTED ENERGY BENEFITS

Community-scale solar is at a sweet spot between utility-scale and behind-the-meter solar. It is neither too big nor too small; it is just the right size to capture community and distributed energy benefits on one hand and utility-scale solar’s economies of scale on the other.

Distributed energy resources provide multiple benefits compared to centralized generation. In RMI’s 2013 report, A Review of Solar PV Benefit and Cost Studies, RMI identified 18 potential benefits from distributed solar. These benefits include including reduced energy losses, grid support services, increased system reliability and resilience, and the potential to defer system upgrades. In addition to being low-cost community-scale solar, therefore, is also high value to the system.

4. AVAILABILITY: COMMUNITY-SCALE SOLAR CAN BE SITED IN THE COMMUNITY TO DRIVE HIGHER ADOPTION

Community-scale solar can also be flexibly sited near loads, opening up sites for development, and avoiding siting and transmission constraints that may impede long-term utility-scale growth. Community-scale solar can be flexibly sited on under-utilized land near loads. For example, EPA’s RE-Powering America’s Land program helps communities and utilities site projects on contaminated land.

Large parking lots can now cost-competitively host community solar, too. According to industry contacts, costs for canopy systems have decreased more than 40 percent since 2014, and parking lot canopies now cost only an additional $0.35/W compared to similarly-sized ground-mount systems.

Local siting can also drive demand for shared systems. Shared solar subscribers appreciate the local aspect of community solar, so demand is often highest for projects that are sited in or near the community. “We find that customer demand for community solar is highest for projects that are sited in or near the participant’s community,” explains Steph Speirs, co-founder of Solstice Initiative. “Community solar customers do not have the constant visual reminder of panels on their own roof, so subscribers appreciate the local aspect of shared solar. They feel more engaged when they can interact with their solar share elsewhere in their community.”

5. AFFINITY: MOMENTUM IS BUILDING

Though community-scale solar is still a small portion of today’s market, momentum is building for sustained rapid growth

Shared solar grew fivefold in 2015. GTM Research and NREL predict sustained growth through 2016 and beyond.

Five states passed shared solar legislation in 2015. 14 states and Washington, D.C., now have shared solar legislation, another 26 states have non-legislated, utility-initiated projects.

Co-ops and munis are getting in the game. The National Rural Electric Cooperative Association’s (NRECA’s) SUNDA program is one example of a program promoting community-scale solar among rural electric cooperatives.

People are collaborating. More than 100 organizations have joined DOE’s National Community Solar Partnership program. The Coalition for Community Solar Access (CCSA) was recently founded as a community solar industry association.

Rocky Mountain Institute is helping to increase that momentum through its Shine initiative. RMI is working with public utilities (i.e., coops and munis), community-based organizations, and developers to unlock this market. RMI is helping coops, munis, and community-based organizations by supporting procurement and business model development. RMI is helping developers and EPCs understand the community-scale opportunity and adapt their designs and business models to best access the market.