Ratio of Debt to GDP Is Manageable, for Now, but Congress Should Take Steps to Address the Situation

By David Wessel

Is the U.S government budget deficit (a) shrinking rapidly and no longer an urgent problem or (b) a looming threat to American prosperity that Congress is neglecting?

Is the U.S government budget deficit (a) shrinking rapidly and no longer an urgent problem or (b) a looming threat to American prosperity that Congress is neglecting?

Answer: Yes.

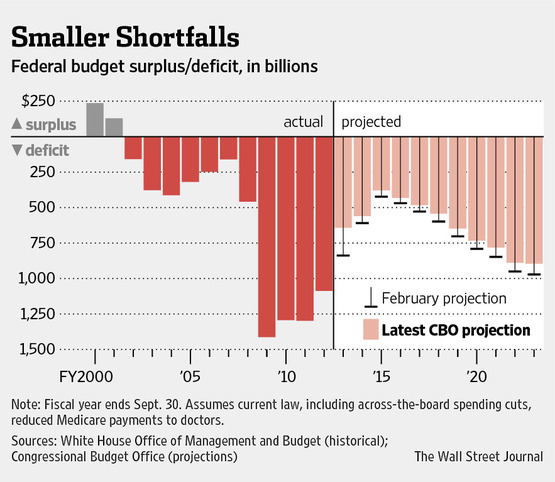

Re (a): The Treasury reported this week that the deficit for the first 10 months of the fiscal year was $607.4 billion, far smaller the $973.8 billion in the same period a year earlier. Revenues are running 14% ahead of last year and spending 3% below, the result of the tax increase that took effect in January, the spending restraint of the so-called sequester and a slowly improving economy.

If the trends persist, the deficit for the fiscal year that ends Sept. 30 will be a bit above 4% of gross domestic product. That’s less than half what it was in the worst of the recent recession, though bigger than any deficit recorded between the recession of the early 1990s and the recession of the late 2000s.

It’s hard to find any evidence that the deficit is doing economic harm today: The U.S. government is still borrowing readily at low interest rates. Government borrowing is not crowding out private borrowing. Inflation is quiescent. The most pressing macroeconomic problem isn’t the deficit, but rather unemployment. The jobless rate, at 7.4%, remains at levels once seen only in recessions.

The deficit outlook for the next few years is looking better, too. That’s because Congress and the president agreed to tax increases and spending restraint (with some reluctance on both counts) and because—for reasons that aren’t completely clear—the pace of health-care cost increases has slowed. The Congressional Budget Office has cut projections for Medicare spending over next decade by $85 billion, or 1.2%, and for Medicaid by $77 billion, or 2%.

The CBO now sees the government’s debt—its total borrowing or the accumulation of all past deficits—stabilizing at current levels, as the chart accompanying this column shows. A year ago, CBO foresaw a significant increase. That is progress.

But re (b): Federal debt is stabilizing at a very high level, around 73% of GDP. That’s higher than any time since the end of World War II and about 30 percentage points higher (about $5 trillion) than it was before the financial crisis and recession.

The notion that there’s some debt level at which the U.S. economy will run into a wall has been discredited. But debt at this level gives the U.S. a lot less fiscal maneuvering room should it run into another financial crisis or severe recession or devastating terrorist attack. Basically, the U.S. cannot count on increasing its debt by another 30 percentage points of GDP and still enjoy very low interest rates.

Prudent politicians would be aiming to gradually reduce the debt burden, both by money-saving changes to benefit programs and money-raising tax policies and by doing what’s necessary to quicken the long-run pace of economic growth.

There’s also the pesky matter of interest. Right now borrowing costs are very low, and yet interest will amount to 6% of federal spending this year, about 50% more than the government will spend on research and development of all sorts. By 2023, even if everything in the economy goes as well as the White House hopes and if Congress accepted every Obama budget proposal, interest would consume 14% of federal spending.

Prudent politicians would be making changes today that will reduce the share of the budget that goes to interest 10 years from now.

And then there are the immutable demographic facts. America is aging, which means more folks on Medicare. And health-care costs per person continue to rise faster than most everything else.

There are lots of big issues in the federal budget: How much defense spending is enough? How strong a safety net is necessary? How should the tax code be overhauled?

No issue is as crucial as finding a way to slow the growth of health-care costs. Health care will account for 25% of federal spending this year and 31% by 2023, according to the CBO. Yes, the pace of growth has slowed, but there’s no certainty that’ll persist unless far-reaching changes are made to the fee-for-service system—and even fans of the Affordable Care Act admit that won’t suffice.

Prudent politicians would be seeking ways to slow health-cost growth and temper the costs of the retirement of the baby boomers.

So what is Congress doing? Heading for a fiscal showdown this fall, and perhaps a government shutdown. But that fight isn’t about any of the above issues. It’s over how much to spend on the one-third of domestic and defense outlays that are appropriated annually, spending that is not driving deficits. And it’s over how to get votes to raise the ceiling on federal borrowing, which every rational person knows is necessary because there’s no way to balance the budget instantly.

A Gallup poll, by the way, reported this week that 81% of Americans disapprove of the way Congress is doing its job.

Write to David Wessel at capital@wsj.com

A version of this article appeared August 15, 2013, on page A2 in the U.S. edition of The Wall Street Journal, with the headline: Deficit Disorder Needs Lawmakers’ Attention Now.

Disclaimer: This is subjective and does not necessarily represent the options and views of Suacci.com